KAMPALA – Diamond Trust Bank (DTB) Uganda has unveiled a strategic pivot towards the growing remittance corridors between Uganda and emerging markets in the United Arab Emirates (UAE) and Asia, as inflows from traditional sources in Europe and North America begin to plateau.

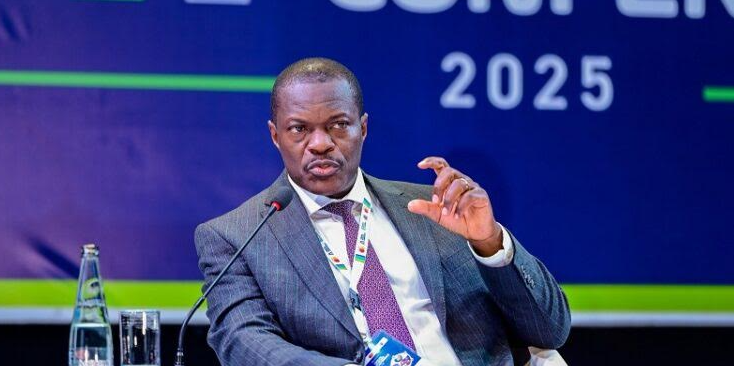

Speaking at the Annual Bankers’ Conference held at the Kampala Serena Hotel, DTB Uganda CEO Godfrey Ssebaana said the shift reflects a changing reality, with increasing numbers of Ugandans now working in Gulf states and parts of Asia. These regions are rapidly overtaking Western markets in terms of remittance transaction volumes.

“For years, Uganda’s remittance story centered around Europe and the U.S. That’s no longer the case,” Ssebaana noted. “We are seeing tremendous growth in transactions from the UAE and Asia.”

However, he warned that many Ugandans in these newer labor markets face significant financial risks due to limited access to financial planning tools and risk management services. In response, DTB is scaling up efforts to offer secure, transparent, and easy-to-use remittance solutions, integrating bank accounts with mobile money platforms to give senders more control and peace of mind.

The bank has also reinforced its partnerships with major global remittance players, including Western Union, MoneyGram, and TerraPay, while investing in digital technology to improve user experience and enhance transaction reliability.

Ssebaana said DTB processes nearly 800,000 remittance transactions annually, giving it deep insight into diaspora behavior and shifting needs. Uganda currently receives over $1 billion in remittances each year—a figure that, he argued, must be translated into long-term development and investment.

“Remittances are no longer just for household consumption,” he said. “Diaspora communities are looking for safe and meaningful investment opportunities back home. We’re responding with innovative financial products tailored to their needs.”

Among these products is simplified access to government securities such as Treasury bills and bonds, which were previously considered too complex or inaccessible for the average diaspora investor. These instruments offer stable returns in Uganda’s relatively stable monetary environment.

DTB is also leveraging remittance data to develop alternative credit scoring models, allowing diaspora clients to qualify for loans—both personal and business—without the need for traditional collateral.

Still, challenges remain. “A significant number of Ugandans abroad want to invest, but lack trustworthy channels,” Ssebaana said, pointing to fraud, unregulated real estate schemes, and general mistrust in local financial intermediaries.

To counter these challenges, DTB is investing in financial literacy and diaspora engagement programs, including virtual financial clinics and webinars tailored to high-volume remittance regions like the UAE and Asia.

However, Ssebaana emphasized that banks cannot tackle these issues alone. “Cybersecurity and digital trust are now essential,” he said. “We urge government to bolster regulatory oversight and cybercrime prevention to ensure a safe environment for cross-border transactions and investment.”

His call was echoed by Moses Muguwa, Commissioner at the Ministry of Finance, Planning and Economic Development. Muguwa highlighted the government’s commitment to strengthening Uganda’s remittance ecosystem through global partnerships and supportive policy frameworks.

“We are engaging with destination countries and global institutions like the OECD, UN, and World Bank to build a seamless and secure remittance infrastructure,” he said.

Muguwa also cited blockchain-based assets and stablecoins as potentially transformative tools, capable of reducing remittance costs from the current 10–20% range to as little as one cent per dollar. He proposed regulatory sandboxes to safely test such innovations and floated the idea of a Diaspora Investment Trust to offer migrant workers secure, transparent investment channels.

On the operational side, Haji Masoud Obeid, Chairperson of the Uganda Forex and Remittance Association (UFRA), stressed the vital role of money transfer operators and forex bureaus in the remittance value chain.

“These bureaus are the frontline connection for many Ugandans receiving money from abroad,” he said, but noted that they face serious hurdles, including liquidity issues, high compliance costs, and technological limitations.

Obeid cited the UGX 50 million average cost of anti-money laundering audits—an expense that small operators struggle to meet. He also raised concerns over limited access to the National Identification and Registration Authority (NIRA) database, which complicates Know Your Customer (KYC) procedures, especially for migrant workers with inconsistent documentation.

He urged the government to grant forex bureaus access to national ID systems to enhance identity verification and reduce fraud, and called for a national campaign to improve financial literacy among remittance recipients.

As Uganda’s remittance dynamics evolve, institutions like DTB are positioning themselves at the heart of this transformation—seeking not only to move money, but to unlock long-term value for the country and its diaspora.