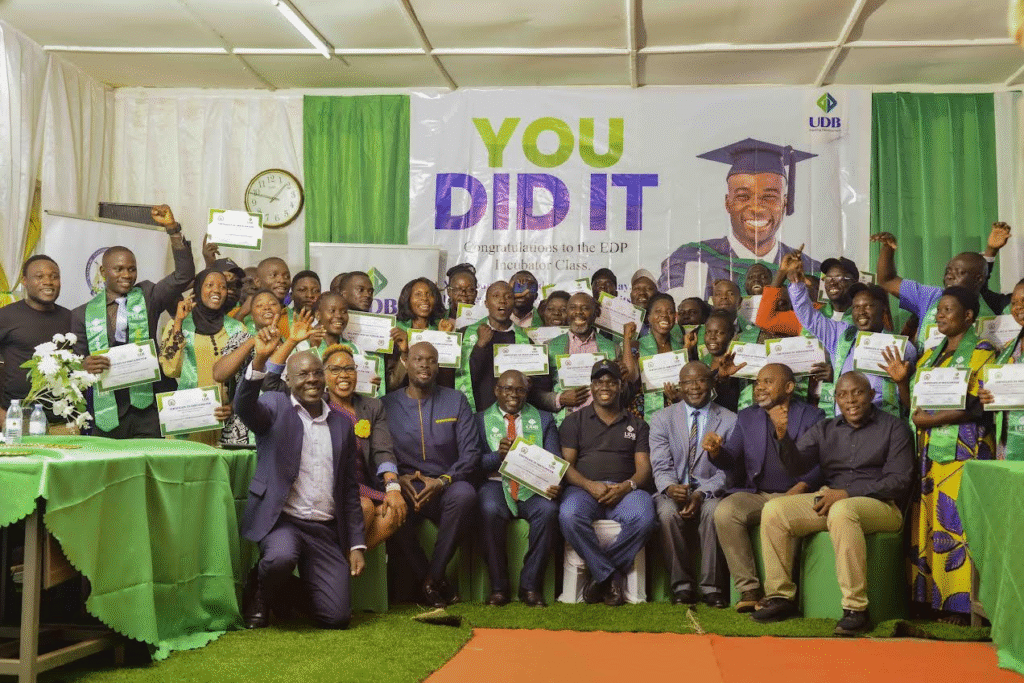

Uganda Development Bank (UDB) has graduated 34 small and medium enterprises (SMEs) from its Enterprise Development Programme (EDP) in Lira, marking a significant stride in its effort to build a stronger, investment-ready business community across the country.

The Lira cohort which initially enrolled 40 enterprises successfully completed a two-month hybrid training focused on entrepreneurship, financial management, corporate governance, marketing, and innovation. The participants represented key growth sectors including agriculture, manufacturing, services and the creative industry areas UDB has identified as critical drivers of job creation and economic transformation.

Speaking at the graduation ceremony held at Lira University, UDB officials underscored that the EDP is designed to strengthen SMEs beyond financial access by equipping entrepreneurs with the right skills to manage, grow, and sustain their businesses. The programme provides intensive coaching and mentorship to help enterprises formalize operations, improve record keeping and build governance structures that enhance their ability to attract investment.

UDB’s Managing Director noted that the bank views capacity development as a vital complement to its financing role, citing that small and medium enterprises make up more than 90 percent of Uganda’s private sector and contribute over 75 percent of the nation’s GDP. “We are intentional about supporting enterprises not only with affordable credit but also with the knowledge and systems that ensure their survival and competitiveness,” she said.

The Enterprise Development Programme works in collaboration with key government and private sector partners, including the Uganda Registration Services Bureau (URSB), Uganda Revenue Authority (URA), Uganda National Bureau of Standards (UNBS), Uganda Investment Authority (UIA), National Social Security Fund (NSSF), and Uganda Women Entrepreneurs Association Limited (UWEAL). These partnerships ensure that graduates emerge fully compliant, formally registered and prepared to operate sustainably.

The graduation in Lira follows similar cohorts in other regions such as Gulu, Mbale and Arua, reflecting UDB’s commitment to decentralize business development services and nurture regional entrepreneurship. The Bank plans to expand the programme to more districts as part of its broader strategy to create a pipeline of viable, bankable enterprises across Uganda.

Graduates of the Lira cohort are expected to use the skills acquired to improve their business models, pursue certification and access growth financing from UDB and other financial institutions. For many, the training has already transformed how they plan, budget, and manage risk laying the foundation for long term stability and expansion.

Through the Enterprise Development Programme, UDB continues to demonstrate that empowering entrepreneurs with both knowledge and finance is the key to unlocking Uganda’s economic potential.