Airtel Mobile Commerce Uganda Limited (AMCUL), in collaboration with Mastercard, Diamond Trust Bank, and Network International, has launched the Airtel Money Global Pay Card—a virtual prepaid card designed to offer Ugandans a secure and convenient means of making international payments.

A New Era of Digital Transactions

The Airtel Money Global Pay Card operates independently from a customer’s Airtel Money wallet, allowing users to load only the amount they need for transactions. This provides enhanced control over spending on services such as e-commerce, entertainment, education, travel, and digital advertising.

Accessible via the MyAirtel App, the card is not only free to create but also free to fund and withdraw from, making it a hassle-free solution for Ugandans navigating an increasingly digital world.

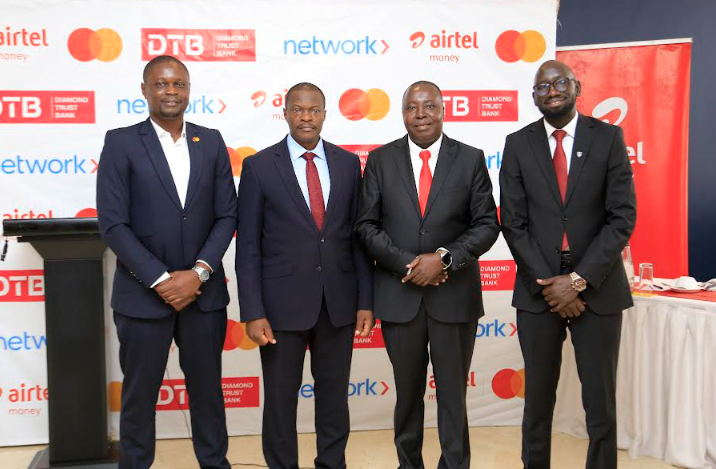

Speaking at the launch, Japhet Aritho, Managing Director of Airtel Mobile Commerce Uganda Limited, expressed excitement about the innovation, stating, “We are delighted to launch a product that reflects our commitment to providing innovative and accessible financial solutions to Ugandans. Recognizing the decline of USSD technology, we are introducing a prepaid Virtual Card through the MyAirtel App. Our partnership with Mastercard, Diamond Trust Bank, and Network International is designed to unlock global opportunities, enabling our customers to seamlessly participate in the digital economy with ease and confidence.”

He further highlighted Airtel’s heavy investments in internet connectivity across Uganda, emphasizing that their upgraded MyAirtel App is now more secure and better suited for a digitally connected and financially inclusive population. “With technological advancements worldwide, it is imperative that we innovate and create seamless, secure, and borderless financial services for our customers,” he added.

Growing Digital Economy in Uganda

Uganda’s digital financial landscape has witnessed remarkable growth, with mobile money transactions soaring to UGX 191 trillion in the year leading up to June 2023. This reflects a 23% increase from the previous year’s total of UGX 156 trillion, according to the Bank of Uganda.

Lenin Oyuga, Head of Telco Digital Partnerships MEA at Mastercard, commented on the collaboration, saying, “The increasing adoption of digital transactions in Uganda underscores the need for partnerships like this. Airtel Money has demonstrated the technical expertise, financial resources, and human capacity to expand the frontiers of digital and financial inclusion. We are confident that the Airtel Money Global Pay Card will provide users with a superior and seamless payment experience.”

Unlocking Global Opportunities

With the Airtel Money Global Pay Card, Ugandans can now access and pay for services from a wide range of international merchants, including:

- E-commerce: Amazon, eBay, and Alibaba

- Entertainment: Netflix, Spotify, and Apple Music

- Education: Coursera, Duolingo, and Udemy

- Digital Advertising: Facebook, Instagram, and X (formerly Twitter)

- Travel & Bookings: Expedia, Booking.com, and Airbnb

- Software Subscriptions: Microsoft, Google, and Adobe

How to Get Started

Customers who wish to take advantage of this service can download the MyAirtel App, activate their virtual card, and load funds from their Airtel Money wallet to begin transacting. For further assistance, they can visit Airtel service centers or contact customer support.

The launch of the Airtel Money Global Pay Card marks a significant step in Uganda’s journey towards digital financial inclusion, offering users a seamless and secure way to participate in the global digital economy.