Airtel Money Uganda has entered a strategic partnership with FINCA Uganda to roll out a new working capital solution dubbed “Easy Float,” designed to help Airtel Money agents access instant loans to top up their electronic float and keep their businesses running smoothly.

Unveiled in Kampala, the Easy Float facility is tailored to address one of the biggest operational challenges faced by mobile money agents, cash flow shortages that disrupt customer transactions. Through the partnership, Airtel Money agents can now borrow small float amounts in real time and repay conveniently through deductions from their monthly commissions.

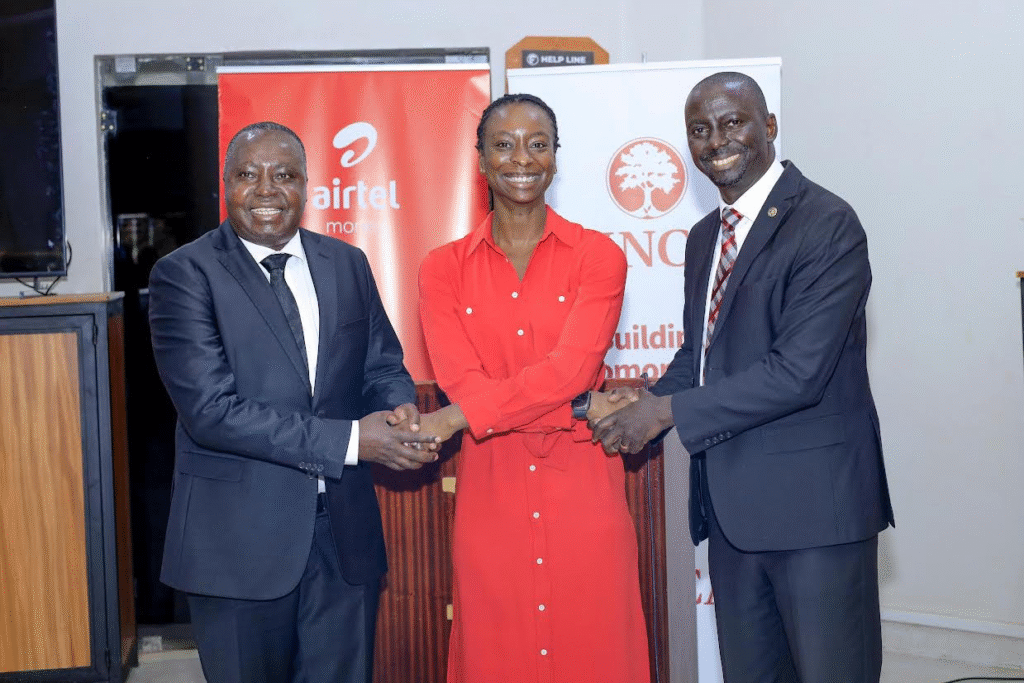

Speaking at the launch, Airtel Money Uganda Managing Director Japheth Aritho said the innovation reflects Airtel’s commitment to empowering its vast network of more than 320,000 agents across the country. “Our agents are at the heart of Uganda’s digital financial ecosystem. Easy Float ensures that even when cash runs low, business does not stop,” he said.

FINCA Uganda’s Executive Director Robert Kakande described the partnership as a step forward in advancing financial inclusion, especially for micro-entrepreneurs who power the informal economy. He noted that FINCA’s experience in microfinance will ensure agents access credit responsibly and affordably.

The initiative is part of Airtel Money’s broader agenda to strengthen agent resilience, improve service reliability, and support the government’s push toward a cash-lite economy. By providing flexible working-capital loans, the two institutions aim to reduce service interruptions, boost transaction volumes, and increase income stability for agents